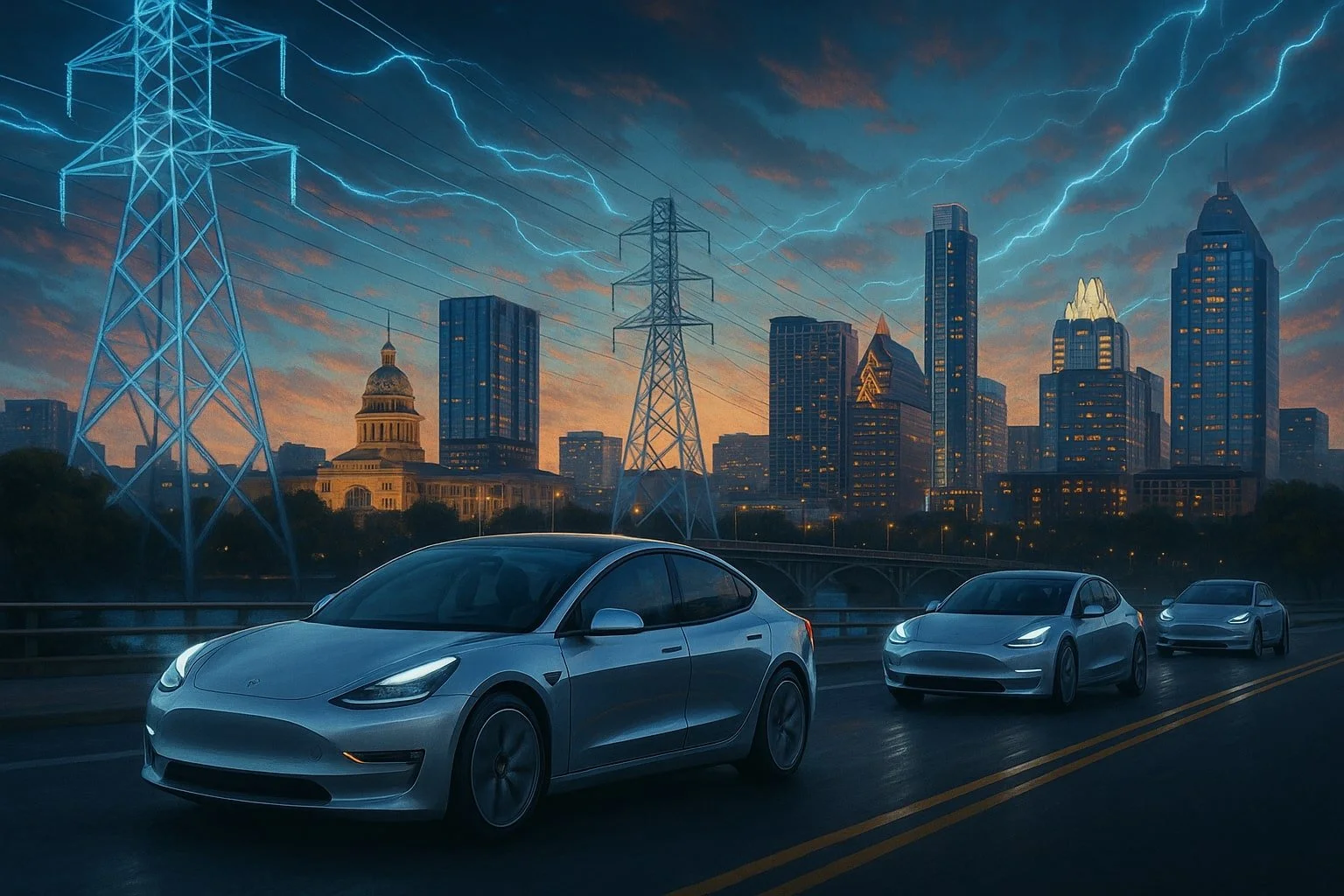

Tesla Robotaxis and the Evolving Demands on Austin’s Power Grid

Navigating Infrastructure Challenges

Tesla’s new robotaxi fleet in Austin is set to significantly increase demands on the city’s power grid, challenging both energy infrastructure and local utilities. With the roll-out of fully autonomous vehicles, each robotaxi will require regular charging, especially as their numbers and daily usage grow. Austin’s electric system must adapt quickly to meet the needs of these advanced, high-mileage electric vehicles.

Managing the intersection of transportation innovation and energy supply will be a key issue for local officials, Tesla engineers, and utility managers. The success of Austin’s robotaxis depends not only on advances in autonomous driving technology, but also on the city’s ability to provide reliable, scalable energy solutions. Readers will discover how this ambitious project is already testing the limits of Austin’s power grid, and what steps are being taken to prepare for the challenges ahead.

Overview of Tesla Robotaxis in Austin

Tesla’s Robotaxi rollout in Austin is reshaping local mobility and testing advanced autonomous ride-hailing technology at a city-wide level. With a growing fleet of driverless EVs, Tesla aims to demonstrate the capabilities of its vehicles while responding to public safety and infrastructure concerns.

Emergence of Autonomous Ride-Hailing Services

Autonomous ride-hailing began gaining traction in Austin as Tesla launched a small fleet of robotaxis powered by its Full Self-Driving (FSD) software. This marks a shift from traditional rideshare services to a model with no human driver present.

Local regulations in Texas provide a flexible environment for testing advanced autonomous vehicles. Austin’s selection as a pilot city is partly due to its openness to innovation in transportation.

Deploying robotaxis enables immediate feedback on how driverless EVs interact with traffic, pedestrians, and unexpected urban scenarios. These real-world operations are crucial for refining Tesla’s FSD algorithms and ensuring safety.

Expansion of Tesla’s Robotaxi Fleet

Tesla has gradually increased its robotaxi fleet in Austin, with the service officially launching in June 2025. Initial deployments focused on downtown and nearby neighborhoods where demand for short, frequent rides is greatest.

Reports indicate the fleet primarily consists of modified Model Y vehicles, with plans to introduce dedicated “Cybercab” designs optimized for ride-hailing. Fleet growth is managed carefully to match both rider demand and power grid limitations.

Fleet characteristics:

All vehicles are 100% electric.

Data from every ride is collected to improve navigation and safety.

Continuous updates to FSD software are pushed via over-the-air updates.

Increasing visibility of autonomous Teslas in Austin’s cityscape has sparked debates on infrastructure, public acceptance, and grid reliability.

Key Features of Robotaxis

Tesla’s robotaxis rely on a suite of sensors, including cameras, radar, and ultrasonics, coupled with advanced onboard AI to interpret and respond to their environment. The vehicles operate without a safety driver under most conditions, supporting true level 4 autonomy on public roads.

Passenger comfort and convenience are prioritized, with automated door operation, spacious seating, and app-based controls for ride-hailing and vehicle customizations. All cars feature advanced safety systems to handle emergency scenarios.

The integration of real-time data connections also enables continuous fleet monitoring, direct communication with support teams, and rapid response to incidents. The result is a ride-hailing experience that emphasizes reliability, energy efficiency, and technology-driven mobility.

Technological Foundations of Tesla Robotaxis

Tesla’s robotaxi platform integrates advanced artificial intelligence, sophisticated sensor arrays, and comprehensive safety standards. These technologies work in concert to support autonomous vehicle operation on public roads in Austin.

Artificial Intelligence and FSD Software

Tesla’s robotaxis rely on Full Self-Driving (FSD) software powered by custom AI. This system processes real-time data from onboard sensors, enabling decision-making similar to human drivers. The FSD stack employs deep neural networks trained on massive datasets, resulting in nuanced interpretation of road situations, traffic signals, and unpredictable obstacles.

Tesla’s FSD software operates in both supervised and unsupervised modes. Supervised FSD requires human oversight, while unsupervised FSD handles the vehicle entirely, though current deployments may still include remote monitoring. Regular over-the-air updates deliver improvements, ensuring the AI adapts to new scenarios in the dynamic Austin traffic environment.

Notably, Tesla’s Dojo supercomputer plays a role in expediting AI training. With its rapid processing capabilities, Dojo accelerates development, contributing to more robust and reliable FSD performance over time.

Self-Driving Hardware: Cameras, Lidar, and Radar

Tesla utilizes a camera-centric approach for its self-driving cars. Each robotaxi is equipped with multiple external cameras covering 360 degrees. This visual data is essential for lane detection, object recognition, and traffic analysis.

Although Tesla’s system does not rely on lidar sensors, which use laser pulses to measure distance, it historically implemented radar units for additional depth perception—especially in adverse weather. In recent models, Tesla has reduced radar dependency, focusing on vision-based AI.

Key Components Table:

Hardware Function Cameras Visual perception, 360° view Lidar Not standard on Tesla Radar Supplemental (limited use)

This sensor fusion approach supports reliable autonomous navigation throughout Austin’s urban landscape.

Safety Protocols and Standards

Tesla’s robotaxi development incorporates safety protocols aligned with established standards in autonomous driving. Before deployment, vehicles undergo software validation, simulation, and controlled road testing to assess FSD reliability.

The self-driving system includes redundancy for critical functions. In the event of sensor or system malfunctions, the AI initiates safe fallback procedures, such as bringing the vehicle to a controlled stop. Tesla states that their software aims to meet and, where possible, exceed regulatory requirements, addressing both occupant and pedestrian safety.

Tesla maintains ongoing collaboration with local authorities in Austin to ensure regulatory compliance. Periodic software audits and real-time monitoring help detect and mitigate potential hazards, keeping autonomous operations as safe as possible.

Impact on Austin’s Power Grid

Tesla's introduction of robotaxis will place new demands on Austin’s electrical infrastructure. Increased electric vehicle (EV) charging, the need for reliable energy storage, and the possibility of heightened peak loads will all shape how the city prepares for autonomous fleets.

Electric Vehicle Charging Demands

With 10 to 20 Tesla robotaxis launching in Austin, the city must anticipate an uptick in electricity demand from EV charging stations. Each Model Y robotaxi will require frequent high-capacity charging, especially as vehicles will be in constant operation rather than charging overnight like personal vehicles.

Charging infrastructure must support rapid charging for operational efficiency. Public and private charging stations may see increased use, resulting in higher electricity consumption during both day and night. This could drive up operational costs for fleet operators and put added pressure on grid management.

The need for strategically placed fast chargers is critical. Tesla and the city’s utilities will need to coordinate to avoid unequal distribution of charging loads across neighborhoods and ensure the city’s grid can accommodate the shift toward continuous fleet usage.

Energy Storage and Load Balancing

The deployment of energy storage systems, such as lithium-ion battery arrays, is essential for absorbing fluctuations in demand caused by robotaxi charging. Energy storage can store electricity when demand is lower and supply it when demand peaks, reducing the risk of brownouts or overloads.

Load balancing becomes more important with fleets that may cluster charging sessions during certain hours. Proper energy storage integration supports both the grid and the economic operation of the robotaxi service by limiting the need to purchase power at peak rates.

Smart charging solutions tied to energy storage can allow operators to shift charging to times when renewable energy production (like solar) is highest. This can help stabilize costs for fleet operators and support Austin's renewable energy goals.

Grid Reliability and Peak Usage

Grid reliability is a key concern as robotaxis create new patterns of electricity demand. Wide adoption of EV fleets increases the risk of system strain during times of peak usage, especially during hot Texas summers when air conditioning already elevates baseline demand.

Utilities may need to upgrade distribution equipment and invest in advanced grid management technologies. Real-time data monitoring and automated controls help prevent outages as charging patterns become more dynamic and less predictable.

Peak demand charges could increase operational costs for Tesla and other fleet operators. Utilities will likely explore demand response programs, incentivizing robotaxi charging during off-peak hours to maintain grid stability and contain costs.

Regulatory and Permitting Challenges

Introducing Tesla robotaxis in Austin has brought a unique mix of legal, regulatory, and social considerations. These automated vehicles must comply with a complex set of rules, secure necessary permits, and address community concerns about safety and reliability.

Legislation Governing Autonomous Vehicles

Texas law allows autonomous vehicles to operate on public roads, provided they meet state-mandated safety and insurance requirements. Several bills address autonomous vehicle deployment, including requirements for vehicle registration, liability insurance, and reporting of accidents or malfunctions.

Local ordinances can also impact deployment. Some city-level regulations may require additional permits or place restrictions on autonomous vehicle operations in dense or sensitive neighborhoods. Effective collaboration with state agencies and the Department of Government Efficiency is essential to navigate overlapping rules.

Most legislation is still evolving as more advanced robotaxis enter public testing. Lawmakers frequently update requirements to account for new technology and potential impacts on the power grid and city infrastructure.

Role of NHTSA and Local Government

The National Highway Traffic Safety Administration (NHTSA) oversees safety standards for robotaxis at the federal level. NHTSA issues guidelines and investigates any incidents involving autonomous vehicles, playing a central role in shaping industry best practices.

Tesla must submit detailed data about its robotaxi technology, including software updates and test results. Local government agencies, meanwhile, handle direct permitting and enforce compliance with city and county laws. They may require safety demonstrations, emergency response plans, or annual permit renewals for fleet vehicles.

Key regulatory hurdles include:

Meeting federal performance standards

Securing city-level fleet permits

Coordinating with Austin Energy and transportation planners about grid demands

Both federal and local agencies work together, but gaps sometimes exist in roles and responsibilities, which can delay deployments or require additional oversight.

Public Safety and Trust

Building public trust is a critical challenge. High-profile incidents with autonomous vehicles have increased scrutiny by both regulators and residents. Austin officials require robotaxi operators to document their safety features and emergency protocols.

Authorities review crash data and monitor the performance of pilot fleets. Public input remains vital, with many local agencies conducting hearings or surveys to gather feedback before granting or renewing permits. Concerns about data privacy, accident liability, and reliability must be addressed transparently.

Ongoing, clear communication helps foster trust and support for new mobility solutions. Tesla and city agencies typically hold community meetings and publish incident reports to keep the public informed. This collaboration between company, regulator, and community shapes permit approval and long-term success.

Market Competition and Ecosystem Players

Several companies are expanding autonomous ride-hailing services as they work to meet rising demand and address infrastructure challenges. Lessons from ongoing deployments in major U.S. cities inform strategies and reveal distinct technology paths.

Waymo and Uber Autonomous Ride-Hailing

Waymo has established itself as a significant player in the driverless ride-hailing sector. It currently operates commercial robotaxi services in Phoenix and San Francisco. These services use a combination of LIDAR, radar, and AI perception software.

Uber, after discontinuing its in-house autonomous vehicle program, has shifted to partnerships with self-driving tech firms. Uber now integrates Waymo robotaxis into its app in select locations. This collaboration allows Uber to offer autonomous rides to passengers while leveraging Waymo’s technology and experience.

The market presence of Waymo and Uber impacts local transportation dynamics, pushing competitors and policymakers to adapt quickly. Their data-centric approaches help improve service efficiency and safety, creating benchmarks for new entrants in this ecosystem.

Comparing Alternative Technologies

Tesla takes a vision-based approach, using neural networks and cameras rather than LIDAR or radar. In contrast, Waymo’s vehicles use robust sensor arrays for redundancy.

This table compares key features:

Company Primary Sensors Core Software Deployment Cities Tesla Cameras Dojo/NNs Austin, Texas Waymo LIDAR, cameras, radar Waymo Driver San Francisco, Phoenix Uber* Varies (partner-based) Integration layer San Francisco, others

*Uber ride-hailing uses partners like Waymo, not its own AVs.

Tesla aims for scalability and rapid software updates, while companies like Waymo focus on system redundancy and gradual service rollouts. These differing philosophies affect grid demand, fleet operations, and adaptability to city-specific needs.

San Francisco as a Reference Point

San Francisco serves as a high-visibility proving ground for autonomous vehicles. Waymo and Cruise have operated fleets here, encountering intricate urban challenges such as steep hills and dense traffic.

The city's mixed results—technical achievements paired with some public backlash—highlight the importance of regulatory collaboration and real-world stress testing. Key San Francisco outcomes:

Autonomous vehicles have logged millions of urban miles.

City regulators have revised guidelines to address safety and congestion.

Public acceptance remains mixed, influencing future deployments in cities like Austin.

The San Francisco experience provides practical insights for Austin, especially as Tesla and others expand robotaxi initiatives.

Implications for Investors and the Broader Market

Tesla’s robotaxi rollout in Austin comes at a pivotal moment for the electric vehicle industry. The intersection of autonomous technology, EV adoption, and shifting energy demands creates both new opportunities and fresh uncertainties for investors and the market.

TSLA Stock Performance

TSLA has historically responded to major announcements with increased trading volumes and price fluctuations. The robotaxi launch presents a potential catalyst, as autonomous vehicles could unlock significant new revenue streams.

Recent performance has been mixed, reflecting broader macroeconomic concerns and competition in the EV space. Institutional investors are closely watching how well Tesla manages charging infrastructure and grid integration, as increased energy demand in Austin tests the company’s scalability.

Short-term volatility is expected, but successful deployment could boost TSLA’s valuation multiples. If the rollout suffers delays or technical setbacks, downward pressure on the stock could intensify.

Date Event TSLA Stock Reaction April 2024 Robotaxi teased +2.7% intraday June 2025 Austin rollout launch To be determined

Wall Street and Analyst Perspectives

Wall Street analysts have expressed cautious optimism. Dan Ives of Wedbush Securities has pointed to robotaxis as a potential game changer, but he also highlights ongoing execution risks.

Analysts at Yahoo Finance note that institutional sentiment around TSLA remains strong, albeit divided. Some point to the potential for recurring revenue from ride-hailing as a positive, while others flag concerns about regulatory headwinds and the readiness of autonomous systems.

Price targets have been adjusted upward by some firms, conditional on early success in Austin. The evolving electricity demand from a growing fleet of robotaxis is viewed as a material risk that could affect Tesla’s profit margins if not managed efficiently.

EV Sales Trends

EV sales in the United States continue to rise, but growth has slowed as competition increases. The introduction of robotaxis may help stimulate consumer interest and set new benchmarks for autonomous technology adoption.

Tesla remains the market leader in U.S. EV sales, but new entrants and established automakers are closing the gap. Analysts highlight that Tesla’s successful robotaxi deployment could reinforce its position and drive additional unit sales.

Energy grid capacity is now a factor in local market growth. In Austin, meeting power demands for an expanding robotaxi fleet will directly impact Tesla’s ability to scale operations and maintain strong sales momentum.