What Happens to Austin’s Car Wash Industry After Robotaxis?

Navigating Changes in Automated Mobility

Autonomous vehicles have rapidly expanded in Austin, with companies like Waymo and Tesla significantly increasing the number of robotaxis on the city's streets. As these electric fleets grow, the demand for vehicle maintenance—including cleaning—shifts from individual car owners to companies operating large-scale operations. Austin’s car wash industry is poised to see a major transition as robotaxi fleets seek efficient, reliable, and possibly specialized cleaning solutions to keep their self-driving vehicles presentable and safe for riders.

Traditional car washes may need to adapt their services and business models to cater to this new market, which operates on different schedules and cleanliness standards than everyday consumers. Questions around automation, partnerships, and even the design of washes may become central to industry survival.

Austin's unique position as a testing ground for autonomous vehicles places its car wash businesses at a crossroads, driven by the operational needs and expectations of robotaxi operators. This shift raises important considerations for anyone invested in the longevity and evolution of car maintenance services in a tech-forward city.

The Rise of Robotaxis in Austin

Austin has become a major testing ground for autonomous vehicles. Industry leaders are racing to deploy driverless fleets, bringing new technology and regulatory questions to the city.

Overview of Robotaxi Launches

Tesla is set to launch its first fleet of driverless robotaxis in Austin, intending to begin service on June 22, 2025. This marks a significant step for Tesla and for the region’s transportation landscape. The company plans to deploy a small initial fleet consisting of about 10 to 20 Model Y vehicles, which will operate without human drivers.

The city’s selection as a testing ground is partly due to its rapid tech growth and flexible regulatory environment. Austin’s streets will soon see routine operation of autonomous vehicles, significantly changing both commuting and ride-service expectations.

Current launches are happening amid federal safety investigations and some public concern about readiness. Regulatory scrutiny may become more intense if there are early incidents or major software failures.

Key Robotaxi Companies in Texas

Several companies are competing for market share in Austin’s autonomous vehicle space. Tesla, led by Elon Musk, is the newest and highest-profile entrant, but they are not alone.

Waymo (a Google subsidiary) has also run pilot programs in Texas, focusing on urban and suburban routes. Cruise, backed by General Motors, has tested vehicles in select Texas cities and is expected to expand into Austin in 2025. Zoox, owned by Amazon, has publicized its ambitions but hasn’t announced Austin deployments yet.

Company Notable Operations in Texas Fleet Model Tesla Starting Austin robotaxi June 2025 Model Y Waymo Suburban & city pilots Modified minivans, SUVs Cruise Testing in select Texas cities Custom AVs, Bolt EV Zoox No active launches in Austin Purpose-built shuttles

Full Self-Driving Technology Advancements

Tesla’s new robotaxi service relies on its Full Self-Driving (FSD) system, which the company claims now requires human intervention only every 10,000 miles in some cases. This represents significant progress compared to earlier autonomous vehicle rollouts. Improvements in AI, sensor arrays, and real-time mapping have all contributed to more reliable performance.

Waymo and Cruise operate with different technology stacks, using both lidar and camera-based systems, while Tesla relies primarily on cameras, neural networks, and advanced onboard computing. Despite advances, self-driving vehicles remain under ongoing federal review for safety.

Reports from industry analysts indicate that the next phase will focus on increasing fleet size, reducing intervention rates, and navigating regulatory approvals. The competitive push for a reliable, scalable robotaxi service continues to intensify in Austin.

Impact of Robotaxis on Austin’s Car Wash Industry

The introduction of self-driving robotaxis in Austin is expected to change how local car wash businesses operate. Major shifts in who needs washes, how often vehicles are cleaned, and what technologies are used are likely as robotaxi companies begin large-scale commercial service.

Shift in Customer Demand

Austin’s traditional car wash industry relies mostly on private car owners and small businesses. With the arrival of autonomous robotaxis, there will be a gradual transition as fleet operators become more prominent customers.

Robotaxi companies are likely to sign contracts with car wash providers or develop in-house solutions. This could reduce the number of walk-in customers, especially if fewer private vehicles are needed in an environment where shared autonomous transport grows.

Businesses may need to adapt their pricing or offer specialized services geared toward commercial fleet hygiene and maintenance. Flexibility in operations can help car washes capture opportunities presented by bulk or scheduled cleaning arrangements with robotaxi operators.

Changes in Wash Frequency and Volume

Robotaxis accumulate more miles and passengers per day compared to personal vehicles, resulting in a higher demand for cleaning. Operators are expected to mandate regular washes to ensure vehicle safety and passenger comfort.

Car washes in Austin might experience increased volume, but with more predictable, contract-based schedules. For example, a robotaxi fleet may require daily or even multiple daily washes, especially during peak pollen or dust seasons.

This shift could stabilize revenue for some operators while sidelining those unable to handle larger, fleet-based demands. The focus for car wash businesses may move from marketing to individuals toward meeting the rigorous needs and standards set by autonomous driving service providers.

Adoption of New Washing Technologies

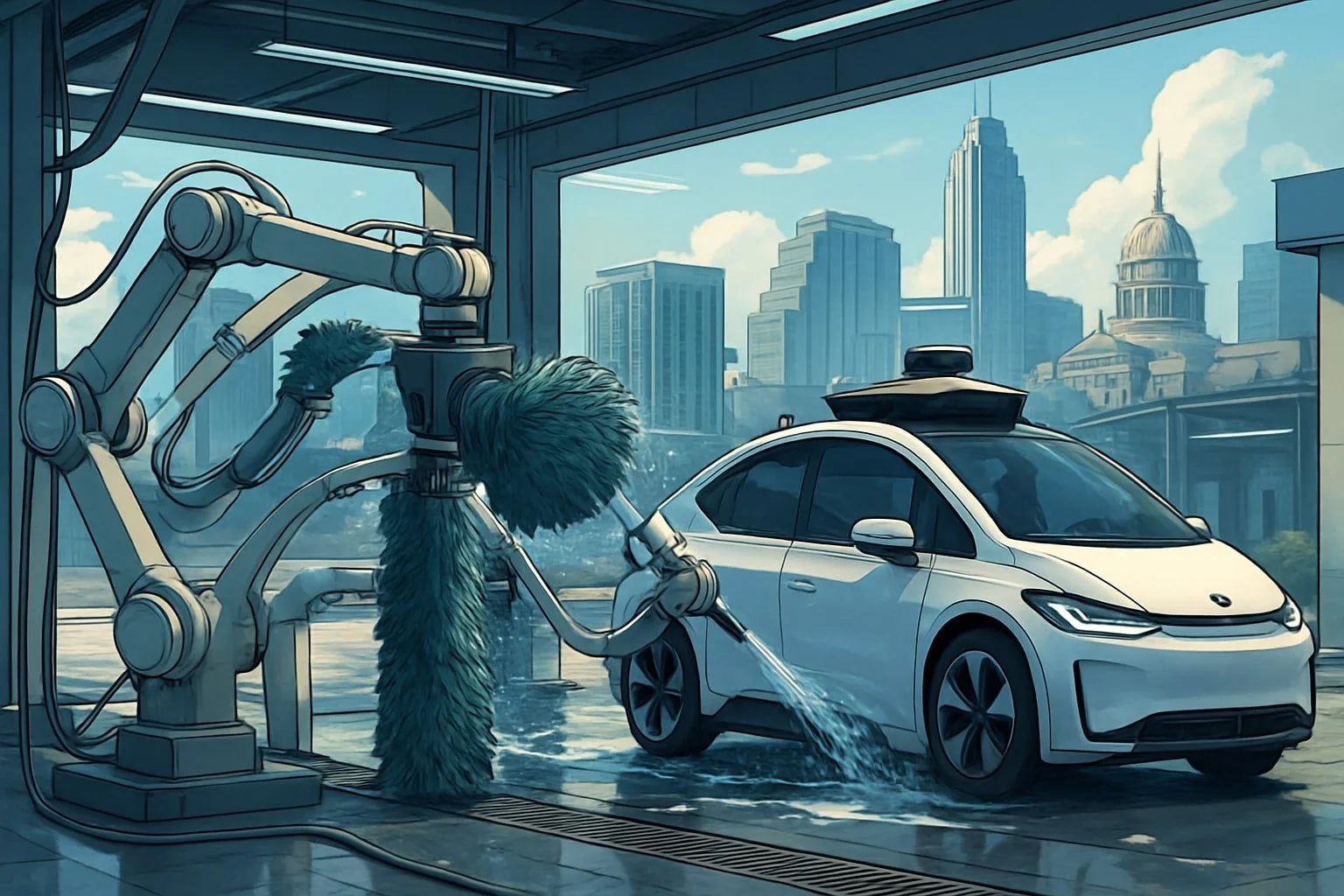

Fleet partnerships with robotaxi companies could accelerate the introduction of advanced washing technologies. Automated, contactless systems that minimize downtime and maximize throughput will be more valuable as fleets seek efficiency.

Some car washes may explore rapid interior disinfection, water recycling, or tracking software that integrates with fleet maintenance schedules. Investment in robotics and IoT solutions could match the innovation driven by autonomous vehicle technology itself.

Competitive edges may come from seamless scheduling, digital payment integration, or even onsite services at robotaxi depots, reshaping the local landscape of Austin’s car wash industry. Bold adaptation will likely determine which providers serve the new wave of self-driving vehicles.

Evolving Business Models for Car Washes

Major shifts in Austin's transportation landscape, such as the rise of robotaxis and electric vehicle fleets, are pushing car wash operators to change how they do business. Many are pivoting from consumer-focused services to models that address specialized needs created by autonomous vehicles, fleets, and new mapping and logistics demands.

Fleet Service Partnerships

Car wash businesses are increasingly developing partnerships with robotaxi operators, mobility platforms, and delivery services. Unlike traditional car washes, these arrangements focus on maintaining the cleanliness and readiness of entire fleets—consisting of cybercabs, electric robotaxis, and vehicles used for mapping and delivery routes.

Many robotaxi companies now require regular, scheduled washes to ensure vehicles meet hygiene and safety standards for passengers. Wash providers may offer on-site or mobile cleaning solutions, reducing the need for long vehicle downtime. Some partnerships also include detailing, sanitization, and touchless wash options tailored to the requirements of electric and autonomous vehicles.

By serving business clients through exclusive contracts, car washes can secure predictable and higher-volume revenue. This shift also means investing in new equipment or processes, such as waterless cleaning technologies and fleet management integrations. Several operators are using software to track service histories, schedules, and mapping data to better support the operational needs of autonomous fleet customers.

Subscription and On-Demand Models

Traditional pay-per-wash models are giving way to platforms that offer both subscription and on-demand services for fleets and individual users. Subscription plans, commonly used by robotaxi or delivery fleets, allow companies to budget cleaning costs and ensure access to priority scheduling or special services, such as expedited turnarounds for high-usage vehicles.

On-demand models, often app-based, meet the needs of mapping vehicles, electric taxis, and other shared-mobility services in real time. This flexibility helps companies deal with variable demand and optimize vehicle availability. For car wash operators, integration with mobility management software and digital booking tools has become essential.

Many businesses provide tiered subscription packages, which may include add-ons such as eco-friendly wash processes, interior sanitization, and vehicle charging. This caters to the regulatory and operational requirements of modern electric robotaxi and delivery fleets, helping maintain service quality while supporting growth in Austin's evolving transportation sector.

Technological Innovations in Car Washing

The car wash industry in Austin is rapidly adapting to the unique needs created by robotaxis. As automation becomes the norm in vehicle fleets, car wash technologies are increasingly focusing on efficiency, consistent service, and minimal human intervention.

AI and Automation Integration

Automated car wash systems in Austin now heavily rely on AI technology to monitor, analyze, and optimize each wash cycle. The deployment of machine learning algorithms enables real-time adjustments based on vehicle size, surface contaminants, and wash preferences.

Robotaxis benefit from these updates through consistent and reliable cleaning, often conducted at intervals set by fleet operators using cloud-based scheduling platforms. Sensor-driven systems identify problem areas—such as heavily soiled panels—and direct mechanical brushes or spray jets accordingly.

Many humanoid robots are being introduced, handling tasks such as vacuuming and interior sanitization. These autonomous units minimize the need for manual labor, reduce human error, and allow around-the-clock operation to meet the high demand for fleet cleanliness.

Remote Support and Maintenance

Remote support teams play a vital role in ensuring continuous uptime for car wash facilities that serve robotaxi fleets. Many systems now include remote diagnostics that send instant alerts when components underperform or fail, allowing off-site technicians to initiate troubleshooting or repairs quickly.

With connected systems, software updates and technical adjustments are frequently handled over the internet without any need for on-site visits. This reduces operational delays and enables car washes to maintain strict schedules expected by autonomous fleet providers.

For hardware maintenance, car washes use networked sensors to track machine wear, chemical usage, and throughput rates. Maintenance cycles and parts replacements are optimized based on real-time data, extending equipment life and minimizing costs.

Audio Sensing Capabilities

Recent innovations in audio sensing give automated car washes a new layer of diagnostic ability. Embedded microphones monitor machine noises, water pressure, and moving parts, detecting anomalies such as clogged nozzles or worn bearings before major breakdowns occur.

These technologies also enable sound-based vehicle inspection, where AI systems identify the presence of foreign objects stuck to tires or undercarriages just by listening. This enhances safety by reducing the risk of equipment damage and malfunctions.

Audio sensing can notify remote support teams or trigger automatic shutdown protocols, preventing costly errors or service interruptions. As robotaxis depend on high reliability, these real-time audio diagnostics have quickly become an essential part of modern car wash technology.

Safety Standards and Regulatory Challenges

Austin’s car wash businesses face new safety and compliance issues as robotaxis become more prevalent. The presence of autonomous vehicles raises unique regulatory, operational, and emergency response considerations that differ from traditional car washing services.

Adherence to Vehicle Safety Requirements

Robotaxis must comply with National Highway Traffic Safety Administration (NHTSA) standards, including federal vehicle safety rules that cover sensors, emergency protocols, and external signaling. Autonomous vehicles often feature sensitive sensors and exterior hardware that can be easily damaged by standard car wash machinery, requiring specialized processes.

Operators must keep updated with NHTSA guidance and any changes to federal regulatory requirements related to cleaning and interacting with automated vehicles. In Texas, additional state and city codes may apply, especially around vehicle inspection and maintenance. Proper documentation and safety data collection help ensure compliance if questioned by local or federal regulators.

Regulatory Compliance and Oversight

The shift to autonomous vehicles means car washes must navigate a maze of new and existing regulations. Environmental laws, OSHA standards, and labor rules—such as regulating chemical exposure—still apply, but additional oversight now includes public safety considerations.

Texas law may mandate special reporting requirements or disclosures, particularly if safety episodes or accidents occur during the washing of robotaxis. Requests through the Texas Attorney General's office or freedom of information requests may access public records about incidents or compliance audits. Car wash operators should coordinate with the city’s Transportation and Public Works Department to stay current on any new industry standards impacting robotaxi maintenance.

Coordination With First Responders

Emergency responders and first responders require specific training and protocols to handle incidents involving robotaxis at car wash facilities. Since autonomous vehicles operate differently in emergencies—sometimes without onboard safety drivers—local agencies, including police and fire, have to establish contact points and disablement procedures in collaboration with service providers.

Clear documentation and sharing of incident response plans with first responders improve both public and operator safety. Communication channels should be formalized, and any safety features unique to the robotaxi fleet should be made available to emergency personnel. Regular drills or information sessions with the Transportation Department can further help prepare for potential emergencies involving automated vehicles.

Competitive Landscape and Market Dynamics

The rapid expansion of robotaxi services in Austin is restructuring the city’s car wash industry. Companies are facing changes in customer profiles, service requirements, and market competition due to the increased presence of autonomous fleets.

Influence of Major Autonomous Vehicle Companies

Major industry players like Tesla, Waymo, Zoox, and Cruise are leading the rollout of robotaxi fleets in Austin. Tesla's pilot robotaxi program in the city will likely set expectations for cleaning frequency and quality standards that differ from personal car owners. Full autonomy (Level 4 or Level 5) shifts maintenance and cleanliness priorities from individuals to fleet operators.

Fleet operators generally require specialized car wash solutions. Contracts may focus on recurring, high-volume cleaning, which incentivizes local providers to invest in automation, eco-friendly solutions, and rapid service turnaround. As Waymo, Cruise, and other companies scale fleet operations, traditional per-vehicle customer counts may drop, but volume contracts can offset this shift.

Fleet managers emphasize operational uptime and consistent cleanliness, which increases demand for reliable, scheduled service. This drives major car wash providers to adapt, invest in technology, and form partnerships with autonomous companies.

Traditional Car Wash Competitors

Austin’s car wash market is valued at around $33.2 billion nationally, and is highly competitive with well-established chains and local operators. The introduction of robotaxi fleets threatens to disrupt the existing customer base, especially among providers primarily reliant on individual consumers.

Traditional competitors face pressure to adapt service models to attract fleet contracts. Key adaptations include customized cleaning packages, dedicated time slots for fleet vehicles, and heightened attention to fast turnaround.

Some smaller operators may struggle to meet the higher volume and efficiency demands of robotaxi fleets. Car wash chains with scale, established technology, and flexibility are better positioned to negotiate contracts with autonomous vehicle companies like Tesla and Waymo.

Role of Pilot Programs

Pilot programs by Tesla and other autonomous vehicle companies in Austin offer an early look at new service requirements for car care. These programs allow car wash providers to adjust operations, pricing, and staffing based on actual robotaxi usage patterns.

Through partnerships with robotaxi operators, car washes gain insight into cleaning frequency, peak usage times, and technical specs needed for fleet servicing. Pilot programs also highlight challenges in washing vehicles with advanced sensors or non-standard body designs, seen in models from Zoox and Cruise.

Feedback from pilot programs helps refine service protocols, ensuring that providers meet evolving expectations for autonomous fleet cleanliness while maintaining profitability and efficiency.

Societal and Economic Effects

The introduction of robotaxis will directly affect employment, city infrastructure, and the way resources are used in Austin. These changes intersect with shifts in mobility, public records data, electric vehicle adoption, and city deliveries.

Job Market Transformations

Robotaxis will likely reduce the demand for traditional car wash attendants and local hand-washing services. As autonomous vehicles typically belong to large fleets rather than individuals, there will be increased interest in automated, high-throughput car wash solutions.

With more fleet-based business, the car wash industry could shift toward larger, technology-driven operators rather than family-owned shops. This change may lower the number of low-skill jobs but increase opportunities in maintenance, technology oversight, and fleet management.

Public records may note a reduction in employment for manual car washing and detailing roles, counteracted in part by specialized positions in robotics, electric vehicle cleaning, and logistics for delivery services. The job landscape will reward technical training over direct labor experience.

Urban Mobility and Infrastructure

Austin’s adoption of robotaxis will alter city traffic patterns and create new demands on mobility infrastructure. Centralized autonomous vehicle fleets could generate concentrated car wash “hubs” near charging and maintenance depots, often situated close to major transit corridors.

New zoning requests and public records may reflect the clustering of commercial washers, especially those compatible with electric vehicles. These fleet-servicing centers will change how and where car wash services operate in the city. Rapid deliveries and robotaxi usage could increase the frequency of vehicle cleaning, impacting both the pace and distribution of car wash demand in urban Texas.

The city may need to develop or update infrastructure to support large-scale, efficient washing—potentially including new water management and energy use standards tailored to the electric vehicle sector.

Environmental Considerations

Fleet-owned robotaxis, especially electric vehicles, pose unique environmental challenges and opportunities for the car wash sector. High washing frequencies may raise water and chemical usage, necessitating stricter adherence to environmental compliance and use of water recycling technologies.

Operators must track and report water usage, run-off, and chemical disposal through public records, especially as city and state regulations evolve for commercial washing of electric vehicles. Some facilities may use advanced filtration systems to reduce wastewater.

Increased regulation and community attention could spur investment in eco-friendly solutions, such as biodegradable cleaning agents or solar-powered car wash stations, especially in areas experiencing rapid growth in deliveries and mobility services.

Future Outlook for Austin’s Car Wash Industry

The arrival of robotaxis and advances in full self-driving (FSD) technology are creating new pressures and opportunities for local operators. Market shifts are already visible as both consumer and business demand patterns adjust.

Scenarios for June 2025 and Beyond

As of June 2025, car wash operators in Austin are facing increased fleet-based demand. The expansion of robotaxi services, many using Tesla Model Y vehicles with FSD, has shifted significant wash volume from individual consumers to commercial fleets.

Fleets require frequent, sometimes daily, exterior and interior cleaning. Operators catering to these new needs are adopting express wash models, offering subscription packages, and upgrading water reclamation systems to handle higher throughput.

Recent industry trends show that companies with automated, high-capacity locations are resilient amid these changes. Membership programs and bulk service agreements have grown, with some facilities reporting up to 30% of their business now tied to ride-hailing or delivery fleets. Traditional walk-in traffic is no longer the primary revenue driver for many sites.

Potential for Full Autonomy

If FSD technology reaches full commercial deployment, with robust software and regulatory clarity, Austin could see fully autonomous Model Y vehicles managing their own cleaning routines without human intervention. Early evidence in 2025 points to partnerships between fleet operators and car wash chains to build out dedicated, automated wash lanes.

Robotaxis may integrate directly with wash subscription systems, allowing vehicles to queue, pay, and even request service upgrades using onboard software. This reduces manual labor needs and potentially increases wash station efficiency.

However, persistent constraints exist. Many robotaxis on city streets in 2025 still require some oversight or intervention for cleaning quality or specialty detailing. The market is evolving, but widespread, fully autonomous car wash cycles are not yet routine. Elon Musk’s vision of seamless, self-managing fleets has inspired rapid innovation, though human roles remain critical in the operational loop for at least the near-term.